The cryptocurrency world was stirred early Thursday as the defunct exchange Mt. Gox transferred $2.8 billion worth of Bitcoin to an unidentified address. This activity occurred just as Bitcoin’s price reached unprecedented six-figure levels, prompting widespread discussion across the crypto community.

Significant On-Chain Movement

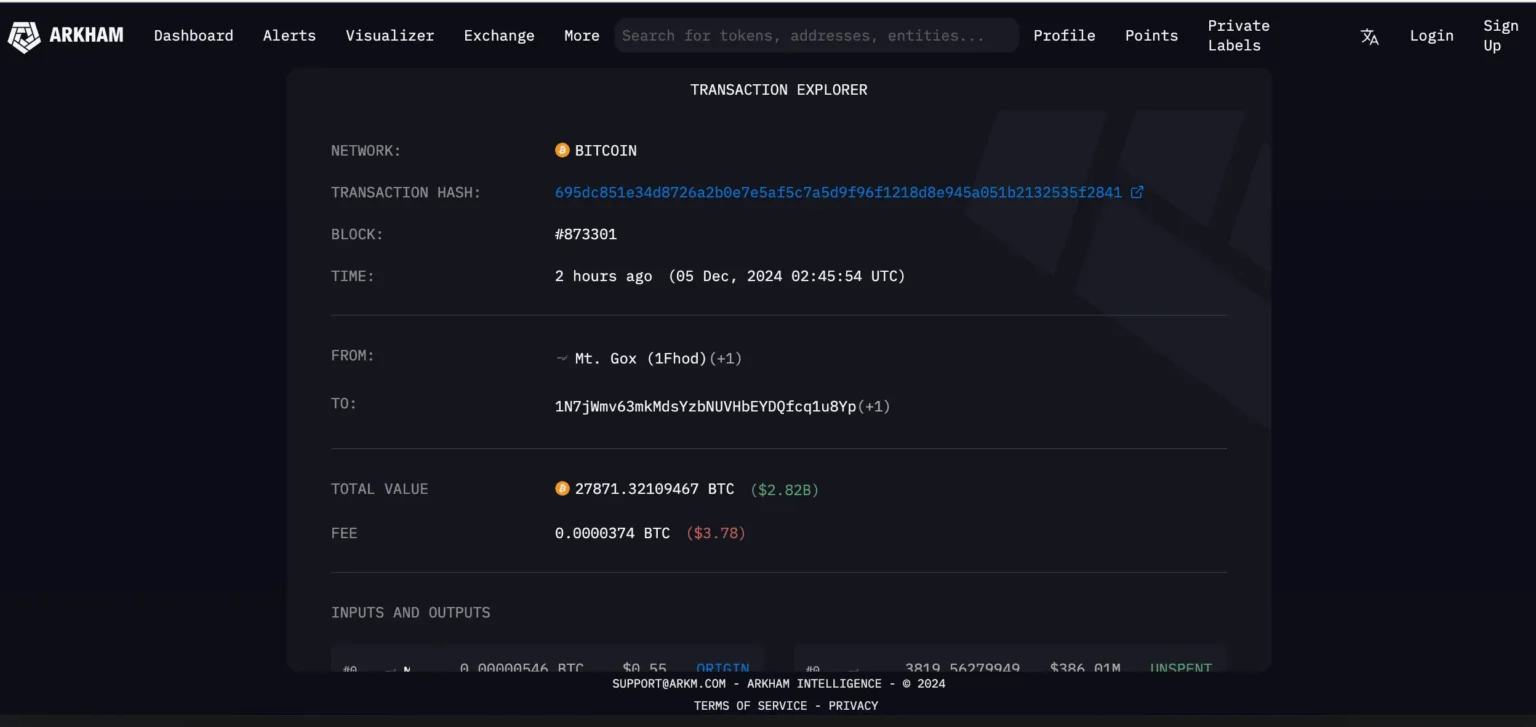

Massive Transfer Sparks Interest

Mt. Gox, a long-defunct cryptocurrency exchange, moved a staggering 27,871 BTC to an unknown address. At current market prices, this transfer equates to $2.8 billion. Despite the large outflow, the exchange still holds a significant reserve of 39,878 BTC, valued at over $4 billion.

Historical Context and Creditor Reimbursements

These transfers are believed to be linked to ongoing creditor reimbursement efforts. Earlier this year, similar movements from Mt. Gox wallets created bearish pressure on the market, although Bitcoin has since recovered. The deadline for creditor repayments was recently extended to October 31, 2025, offering some clarity to those affected by the exchange’s collapse.

Market Reaction and Bitcoin’s Stability

Bitcoin’s price continues to show resilience despite these significant movements. At the time of writing, Bitcoin is trading steadily above $103,000, maintaining its bullish momentum.

Minimal Impact on Market Sentiment

While large on-chain transfers typically raise concerns about potential sell-offs, Bitcoin’s steady performance suggests the market has absorbed the news without panic. This reflects growing maturity and confidence among investors, even as questions about Mt. Gox’s holdings linger.

The Bigger Picture

The resurgence of Mt. Gox in the news highlights the lingering impact of past events on the crypto ecosystem. Despite its collapse nearly a decade ago, the exchange’s unresolved holdings continue to influence market dynamics.

Bitcoin’s ability to maintain stability amid such significant movements underscores its strengthened position as a financial asset. As the market matures, these large transfers are less likely to cause widespread volatility, marking a positive step forward for the cryptocurrency’s global adoption.

What Comes Next?

As Bitcoin remains above $100,000, all eyes will be on Mt. Gox and its next steps. Creditor repayments, future wallet activity, and the timeline of asset distribution will continue to shape discussions within the crypto community.

For now, Bitcoin’s resilience amid these developments demonstrates its robust demand and growing investor confidence, setting the stage for potential new milestones ahead.