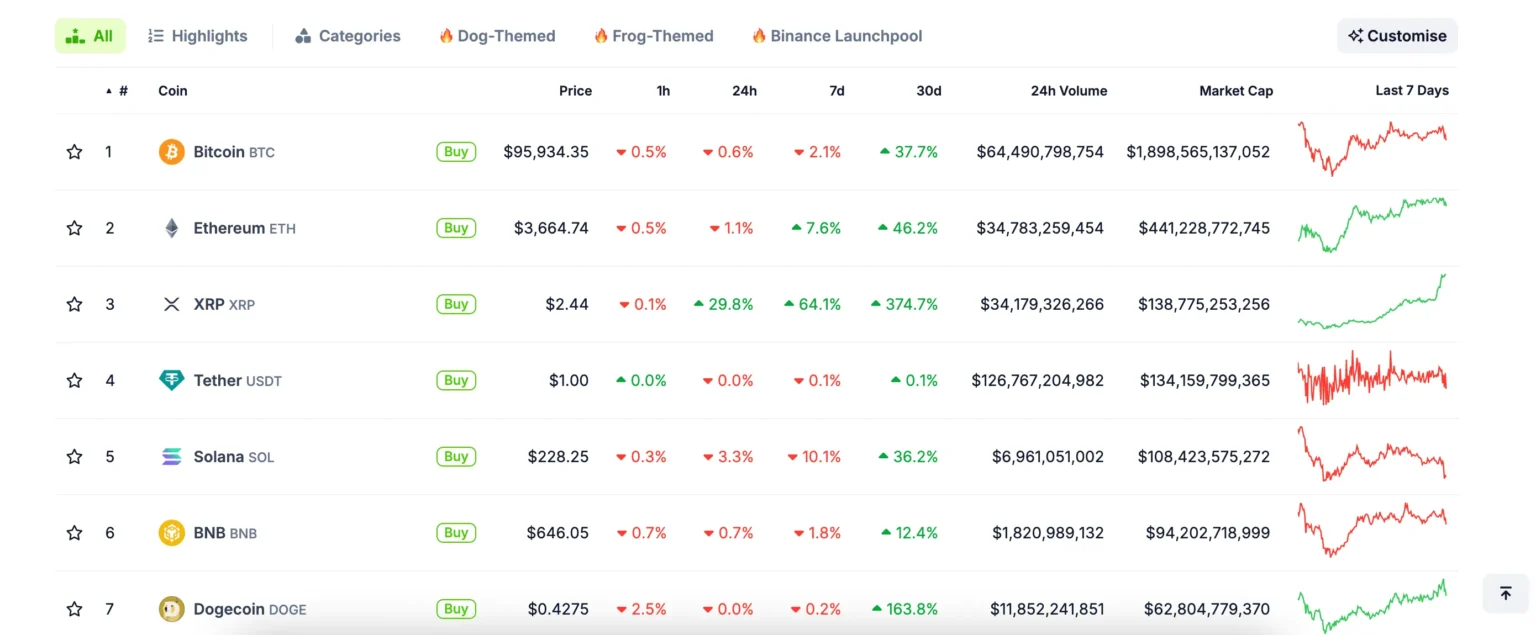

XRP has experienced an explosive rise, overtaking Tether (USDT) to secure its place as the third-largest cryptocurrency by market capitalization. Meanwhile, Bitcoin (BTC) faces substantial resistance as it struggles to break the $100,000 mark.

XRP’s Meteoric Rise and Market Dominance

In just 24 hours, XRP surged by over 20%, propelling it to a new market value of $139 billion. This price jump pushed XRP past Tether’s USDT, making it the third-largest cryptocurrency globally by market cap.

- XRP’s 30-day performance is equally impressive, showing a 375% increase, reaching $2.40 per token.

- The surge has sparked renewed interest in XRP, with many speculating that the return of retail investors to the crypto market could be one of the key drivers behind this surge.

Drivers of XRP’s Momentum

Several factors appear to be driving XRP’s recent surge:

- TikTok Trends: XRP’s presence on social media, particularly TikTok, has contributed to growing retail interest.

- Speculation on Ripple’s Stablecoin: Rumors around the approval of a stablecoin issued by Ripple have further stoked excitement in the market.

- ETF Possibility: Speculation regarding the potential launch of an XRP Exchange-Traded Fund (ETF) is fueling investor optimism.

According to Mena Theodorou, co-founder of Coinstash, these developments are likely driving the renewed XRP momentum.

XRP Trading Volumes Surge Globally

The surge in XRP trading volumes has been remarkable. For example, Upbit, South Korea’s largest cryptocurrency exchange, reported a record $4 billion in XRP trading volume over the past 24 hours. This accounted for over 27% of Upbit’s total trading volume, according to data from CoinGecko.

This uptick in XRP activity comes as South Korea delays its planned crypto capital gains tax until 2027, removing a key regulatory hurdle that could fuel more speculative trading in the crypto space.

Bitcoin Struggles with $100,000 Sell Wall

While XRP is surging, Bitcoin is facing strong resistance near the $100,000 level. The price of BTC has been trapped between $90,000 and $100,000 for the past two weeks, with upward movement faltering due to a significant sell wall.

- A $384 million sell wall around the $100,000 mark is limiting Bitcoin’s ability to break above this psychological barrier.

- Valentin Fournier, an analyst at BRN, notes that despite strong market catalysts, Bitcoin needs to overcome more than 4,000 BTC in sell orders before moving higher.

Shift in Market Sentiment: Bitcoin’s Declining Dominance

Bitcoin’s market dominance, which had been as high as 61.5% in November, has decreased to 56.5%, reflecting a shift towards altcoins. This decline in dominance indicates that traders are rotating capital out of Bitcoin and into other cryptocurrencies.

- As Bitcoin’s dominance drops, liquidity is flowing into assets like XRP, contributing to the altcoin surge.

XRP’s Momentum Gathers Steam

XRP’s rise to the third spot in the cryptocurrency rankings is a clear indicator of growing market confidence. The factors driving this surge, from social media buzz to regulatory developments, paint a promising picture for XRP’s future.

Meanwhile, Bitcoin continues to face significant hurdles, with a large sell wall around $100,000 and declining market dominance. This shift in market dynamics could lead to further capital rotation toward altcoins like XRP, positioning it as a top player in the crypto space.